Installment Loans

Contents

2020 Installment Loans Guide

Installment loan is a classic financial product that is provided on repayment terms, urgency (a strict schedule of payments is established) and payment terms (interest rates and commission charges are specified in the contract). The loan size always depends on bank current tariff policy, therefore, amount of money that can be borrowed is limited by the precise credit limit. Nowadays, the principle of crediting comes to replace the principle of savings: by planning spending that exceeds one-time investment opportunity. This, of course, is a more convenient way for the buyer, because it’s not a fact that selected product will wait for you if you set aside it for a year. Skipping opportunity of a bargain is especially easy in conditions of an abrupt rise in prices.

Not long ago, in order to receive an installment loan was necessary to personally visit a bank, sometimes more than even once. This method still exists now, but every year it loses popularity due to unreasonable time costs.

Usual conditions for installment loans

The creditor in processing an installment loan is a commercial bank or a trading company through the borrower plans to purchase goods. Specific conditions and nuances of the future transaction are specified in the loan agreement. The size, term, and cost of lending are calculated by the financial manager on the basis of reliable data provided by the borrower in his application.

Features of installment lending:

- strict financing terms for customers;

- targeted use because if the borrower does not indicate the purpose of the loan, the cost of the loan increases;

- possible use of collateral (collateral, guarantee) in order to reduce value of the transaction;

- a fixed amount of regular payments, including commission and interest charges;

- clear time boundaries of the contract (from a few days to several decades).

As you can see, conditions for installment loans are pretty strict and the loan itself usually taken for quite a long time.

What are the differences between installment and payday loans?

Firstly, it is the difference in terms of lending. Payday loans for the people are issued for a short period of time, in rare cases, it exceeds 1 year. More often, these payday loans are usually taken for a couple of weeks. The amounts are also relatively small from 100 to 1000 dollars. In some cases, it can be much higher.

Secondly, it’s accessibility. To issue a payday loan will be enough just a few documents (including an income statement). Often, on creditor sites, a percentage of a positive loan decision can be up to 98 cases out of 100, and some credit brokers offer loans even without refusal (of course they are cunning, simply applying for several financial organizations at the same time, which greatly increases the probability of a positive decision).

For payday loans, decision-making time is almost instantaneous. It can take just 20-30 minutes (although not always), especially when making an application online with a card, account or e-wallet. This service is also available for persons with a damaged credit history, which can be corrected by taking and timely repaying such debt.

As you see, for installment loans decision on credit application can take more efforts and payments divided also for a long time. So, before to consider which loan is better for you, look at its conditions.

How quickly and conveniently you can get installment loans using our service

Anyone who has ever encountered needs to lend money is interested in the question: which bank or financial organization has the lowest interest on consumer loans? Indeed, finding a profitable option is not an easy task. But with the help of our service, you will be able to compare all available credit options without any problems and choose the most suitable one for you. To do this, you just need to enter required amount and desired maturity. After that our system will make a list of the offers – verified banks and financial organizations, where you can take required installment loan on the best conditions.

Pay your attention not only to the loan base rate but also to the terms of service, because there can be hidden some of the additional fees, which can significantly increase the overall financial burden. Also, consider possible fines charged for late payment. In addition, some banks remove an additional percentage for early repayment. To find a profitable option for yourself, all these nuances should be considered on a par with the interest rate, since the amount of overpayment strongly depends on it.

Basic requirements for the borrower

Today, an installment loan is one of the most popular financial products among the people. Many of them use that kind of loan to buy a car, home appliances, build a house or repair an apartment, and get additional services (educational, medical).

In order to guarantee installment loan, you need to understand what requirements are placed on potential borrowers and what can be done to reduce interest on the loan.

PLS Cash Advance has very simple requirements for borrowers:

- a potential borrower must be of legal age;

- be the owner of a valid ID;

- must have a mobile phone;

- working current account (banking details and Social Security Number);

- pay slips or prove to income (please note that sometimes will be necessary to supply additional information);

- have a valid electronic address;

- a filled application form.

How to obtain an installment loan for a person with a bad credit history

People with a difficult life situation are probably interested in the question – which bank today gives installment loans even to those borrowers who have a bad credit history?

According to statistics, every fifth family in the United States has credit obligations to the banks. Unfortunately, due to the ever-expanding crisis and loss of work many borrowers unable to pay their loans on time and because of these their credit history lay in ruins.

A bad financial record is not a reason to think that, roads to the credit is closed to you. There is always an opportunity to take a loan even with a spoiled history but at higher interest rates. Besides that, you can find many ways how to correct your CI and again achieve a loyal attitude of creditors towards you. Some effective ways are presented in this article.

In addition, there are situations when the credit score can spoil for reasons beyond control of the borrower. For example, if you were in a hospital at the time of redemption, or if you were cut off from work without notice or did not get paid your salary on time, you should definitely meet with a bank specialist and explain the reason for your debt. Of course, you will need to provide all supporting documents.

And after all, you must always remember that a bad financial record is not a reason to think that from now on, roads to banks are closed to you. If the borrower has bad credit loans/score, then it is always quite problematic to apply for a new one. All debt service delays are reflected in a personal credit history.

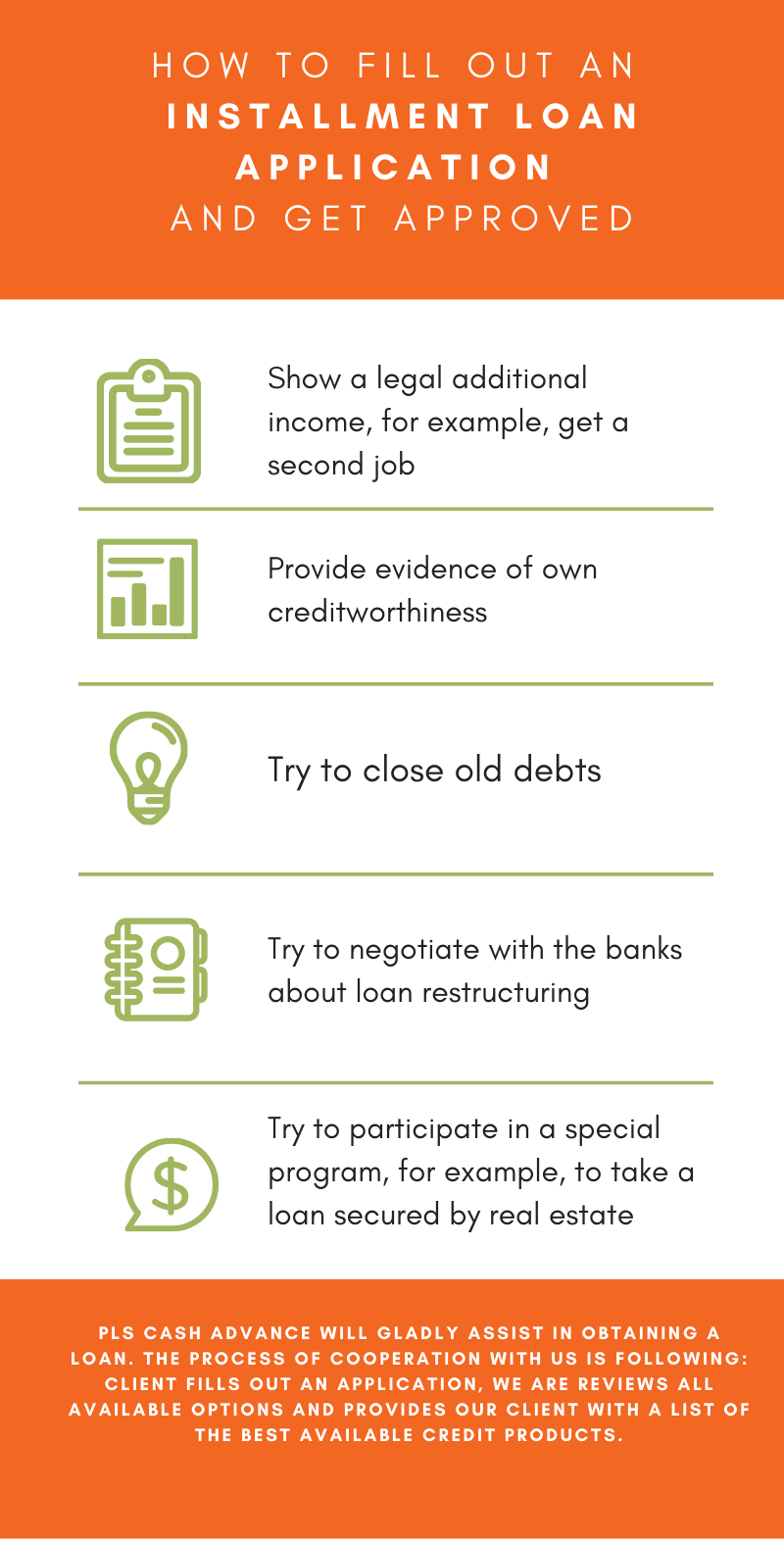

How to fill out a installment loan application and get approved

Therefore, before a new application, it is better to carry out the preparatory work:

- try to close old debts;

- if this is not possible, try to negotiate with the banks about loan restructuring or about changing current conditions to more beneficial for the borrower.

- show a legal additional income, for example, get a second job;

- provide evidence of own creditworthiness;

- try to participate in a special program, for example, to take a loan secured by real estate.

Most banks are quite scrupulous about borrower’s choice. Sometimes they even denied a loan to clients whose have seemingly perfect financial report and high earnings: for example, for bank manager is unclear why a person with a large salary has a tiny loan?

Unlike them, we give our customers a real opportunity to get an installment loan. We work with many partners and ready to give you all help you need for guaranteed second chance loans.

We can offer you several ways which can help to get an amount of money you need.

PLS Cash Advance will gladly assist in obtaining a loan. We find such a credit product, which can be taken even with a very bad payment history. The process of cooperation with us is following: client fills out an application, we are reviews all available options and provides our client with a list of available credit products.

What extra knowledge do you need about our installment loans

Installment loans are a Legal and Regulated type of loans, the client is protected by law, all payments are transparent and known in advance, loans are easily restructured and have a positive effect on credit score in case of a successful repayment.

What are extra advantages of installment loans?

For the beginning, such loans are advantageous because of their obtaining speed. And also:

- decision-making on installment loans takes from half an hour to 1 day;

- Installment loan does not affect credit score (FICO® SCORE – used in over 90% of U.S. credit lending decisions)

- you can use funds received as you like.

- although application usually needs to fill in the credit goals, no big attention will give to this column;

- you can get an installment loan in the convenient form for you;

- no less convenient is the minimum set of requirements for borrowers, there are restrictions only on age (from 18 years of old).

In order to successfully go through all stages of your application, use our professional services. Experienced company specialists are well aware of their work and will do everything possible so that you get an approval for an installment loan.

PLS Cash Advance will help you to get right installment loans on the best possible conditions!

Installment loan rates starting from 5.5% APR

GET UP TO $35,000 as soon as tomorrow!

We have deep experience in helping people find online personal installment loans that meet their needs and fit their budget.