Get Cash NOW!

Simple Online Solution to Get Cash Loan Fast.

Fast, fair and friendly online service from a company you can trust. You’ll get the answer immediately after you submit an application.

Start Right Now

APR is the annual cost of funds, which is calculated over the whole term of any credit.

What is Annual Percentage Rate (APR) for Short Term Payday Loans?

Updated 02/19/2019

Contracting a loan, one should mind that before you conclude a contract with the banking establishment or loan provider, you should learn a number of useful facts about the loans and calculate all running costs. This refers to APR or Annual Percentage Rate.

APR – What Does This Notion Mean?

This is an annual rate charged for borrowing money or the amount of cash you will be obliged to pay over the term of a credit. In a similar vein, this is the annual cost of funds, which is calculated over the whole term of any credit. Because of the fact that loans vary in terms greatly, the main goal of APR is to show the borrower the total sum an individual has to pay over the crediting period.

To put it simply, the APR helps you determine how much you will overpay for your credit. One more point that is very important is that you should compare the terms of loans from different credit providers.

The APR means the rate, which shows the sum you will overpay if you contract a credit for the whole year. To calculate the daily rate you need to know the APR and divide it by 365 days. You should also make allowance for the fact that some lenders divide credit cards by 360 days instead of 365 days.

By law, each loan provider is obliged to provide their customers with the APR. In doing so, they show borrowers actual rates of their agreements.

Speaking about loans, it stands to mention that this type of credit is offered with variable or fixed APR. The principle difference is that the percentage rate of the fixed APR loan doesn’t change during the whole crediting period. The lending rate of the variable APR may be changed by the loan provider. In many instances, lending companies have floating (or variable) APR.

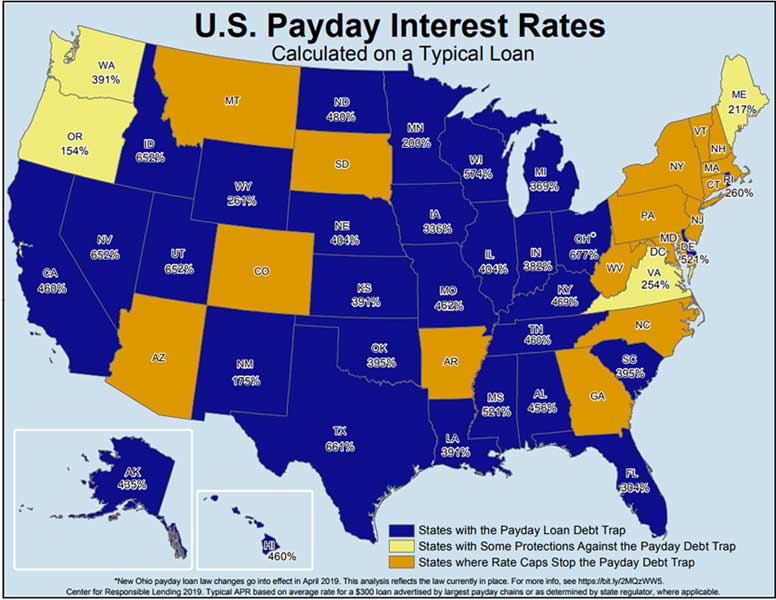

U.S Payday Interest Rates

APR and Interest Rate: What is the difference?

Before taking any loan, each borrower has to find a reliable lending company and understand all peculiarities of this procedure. Everyone interested may find a reputable lender by dint of plscashadvance.com – the best matching service, allowing lenders and borrowers find each other.

Having found a lending company, one should understand how to calculate the cost of a loan. Independently of rather profitable terms, this offer is not free! Besides, it is of prime importance to understand how the interest rate differs from the APR.

A percentage rate means the “interest charged on a loan”. Generally, it doesn’t comprise any other expenses. The amount of APR is greater comparing with the interest rate. This is a wider notion because it includes all fees and interest expenses that are involved in the procedure of procuring a loan. It comprises an interest-rate structure, late penalties or transaction fees. Besides, some other factors are also included.

APR is an excellent indicator showing you how much you will overpay. It simplifies the process of calculating the real expenses of any borrower. Besides, APR is very useful for those who search long-term loans.

It makes no matter what form of credit you apply for, you have to know everything about all expenses you will be obliged to incur. The same is with the percentage rate and the APR. Never put blind trust in the promises of a lending company. You have to control the information by yourself. Besides, take loans only from reliable credit providers. You can find them on our matching service – plscashadvance.com.

Top Ten States where Payday Loan Rates are the Highest

Payday loans are quick and short-term loans, it is important to distinguish between the price of the loan and the annual interest on it: the average payday loan borrower pay from $10 to $16 per $100 for the whole term of crediting (typically between 14 and 30 days).

| State | Possible APR |

|---|---|

| Ohio | 677% |

| Texas | 662% |

| Utah | 658% |

| Idaho | 652% |

| Nevada | 652% |

| Virginia | 601% |

| Wisconsin | 574% |

| Delaware | 521% |

| Mississippi | 521% |

| North Dakota | 487% |

Get a free, no obligation quote from state-licensed lenders.

Fixed monthly payments.

No hidden fees.

GET STARTED