Texas Loan Legislation Broken Down

Payday Loan Process in Texas

Last Revised 04/04/2020

The purpose of any debt instrument, including microloans known as payday loans, is to make the required amount of money to consumers readily available within the shortest period of time, because they are urgent, as a rule. Too much hassle and delay defeats the purpose, and this is exactly why the popularity of online payday loans grows by day: they are everything a borrower needs.

Applying for a loan at the company’s office entails too many efforts and is understandably more time consuming than applying for a loan online. Statistically, the percentage of rejections considerably increases with offline applications, which is yet another factor contributing to the increasing popularity of online payday loans.

Texas Payday Loan Laws and Regulations

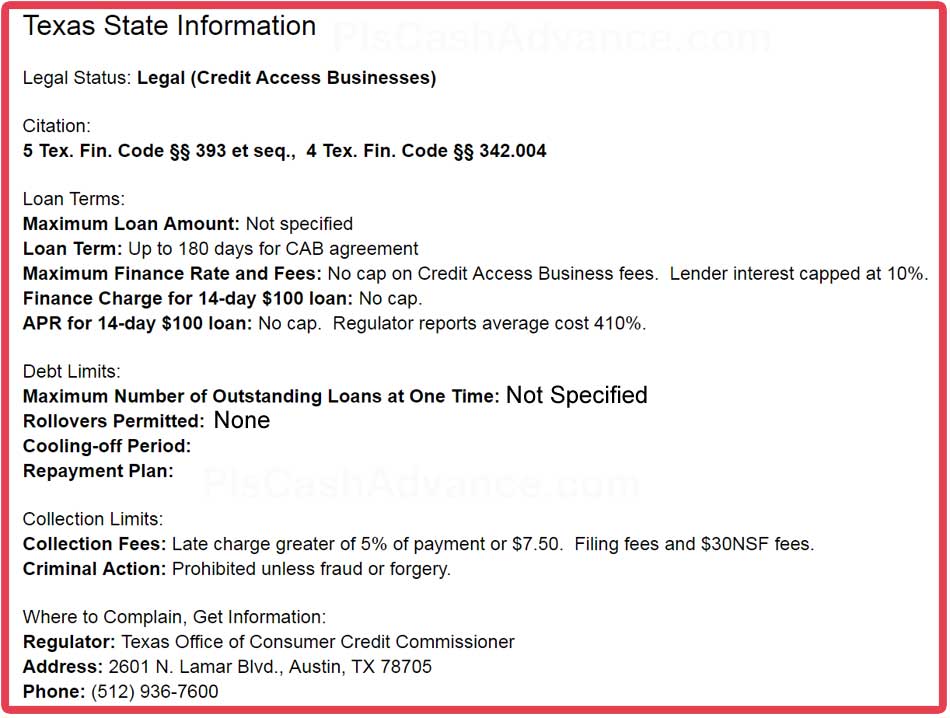

Texas payday loan institutions are regulated by statutory citation Tex. Fin. Code Ann. §341.001, Tex. Fin. Code Ann. §342.601 et seq., Tex. Fin. Code Ann. §393.221 et seq., Texas FINANCE CODE §393.604 et seq..

According to these documents any payday loan made to individuals within the state:

- should not exceed the term of 180 days;

- should not be issued for less than 7 days;

- should not exceed the amount of $200;

- there is no credit cap with lender interest cap at 10%;

- maximal APR rate on every $100,00 loan is 410%

It is required for the agreement on a payday loan issued in Texas to specify that the loan is of a short-term nature, as well as include the precise amount of the loan, the fees itemized, lender’s full name and the date of signing the agreement should also be specified.

Texas Consumer Protection

In order to ensure the ultimate consumer protection, Texas payday loan legislature provides regulations that prevent lenders from charging more than one-tenths of the outstanding principal balance;

- for loans in the sum of $35 and below, the maximal acquisition fee should not be more than $3;

- no more than $3.50 if the sum ranges between $35 and $70;

- no more than $4 for the sums between $70 and $100

- no more than $10 for every $100;

- no more than $4 for every $100 in case of installment loans

The lender may earn the minimum acquisition charge and an interest for a month in case of prepaid loans, even if the term of such cash advance is longer than one month. For loans not exceeding one month, the rate is calculated based on true daily earnings rate, the duration of the loan term and the amount of the cash advance.

With the help of elaborately thought-through laws, the legislature of Texas effectively regulates the mechanisms of cash advance issuing for individuals in the state. This prevents lenders from preying on consumers with bad debt situation, insolvency, or inability to make a payoff with sufficient funds remaining in their checking account to pay for other important expenses in their lives. If you have a complaint against a Texas payday lender, you should filling the form trough the TEXAS OFFICE OF CONSUMER CREDIT COMMISSIONER (OCCC). This office assists Texas consumers in resolving issues against non-depository lenders. If you fall victim to illegal practices, you may have the right to sue for damages under the Deceptive Trade Practices Act. In this case, you should visit https://www.texasattorneygeneral.gov

A safe and fast way to have a payday loan issued is to apply online using a service that finds a lender with the best rates and the best chances for approval. Such services connect users only to law-abiding lenders who are also more willing to lend money to customers with non-existent or less-than-perfect credit history. Borrower receives the money into their specified account without the need to leave any kind of deposit or present any documents in person: exactly the kind of benefits sought after when applying for a fast, efficient and guaranteed cash advance!