Virginia Payday Loan Legislation and Law

Payday Loan Process in Virginia

Consumers of payday loans, or microloans as they are otherwise referred to alluding to their smaller size, in Virginia have several options when it comes down to how they can apply for a cash advance. They can do it either in person or online, based on their personal preferences and particular circumstances. Statistics show, however, that more and more borrowers seek to apply for a payday loan from their computers, since this practice has several advantages, namely:

- online payday loan application is less time consuming

- there is no need to leave work place to apply for a loan

- there is no need to leave a deposit

- there is no need to collect numerous documents

- online payday loan lenders have better approval rates

- max. finance charge payable for every $100,00 is $26.38

- fixed APR is 36%

- roll-overs are prohibited in Virginia

- a cool-off period of 1 day is required after a payoff

- a cool-off of 45 days is required after 5 consecutive loans

- a cool-off of 90 days is required after a pay plan

Virginia Payday Loan Laws and Regulations

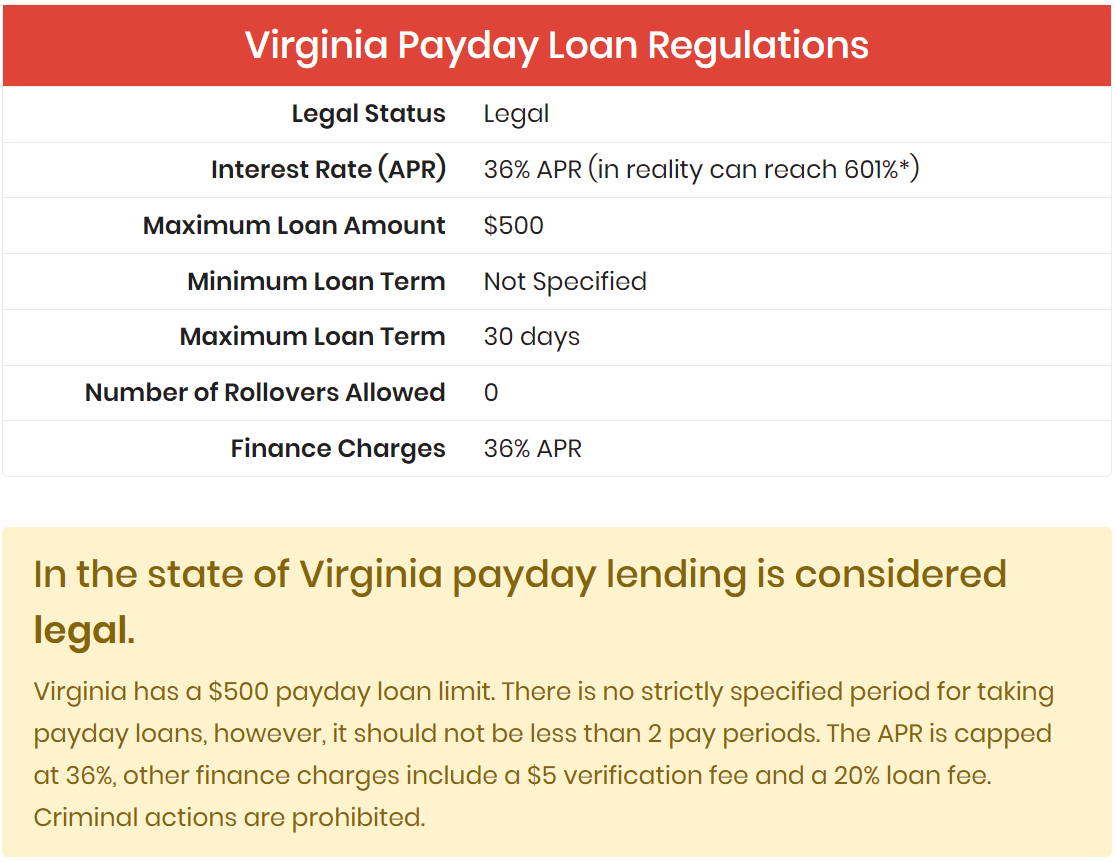

Lenders issuing payday loans in Virginia are subject to regulation by statutory citation 6.2-1800 et seq., which determines that the maximal amount made to individuals as cash advance is $500,00 to be repaid during the maximal amount of two borrower’s pay cycles. By the end of the payday loan term the financial fee should not exceed 6% payable in APR.

Simple annual rate charged and received by the lender should not exceed simple annual rate of 36%, and be no more than 20% of the outstanding principal balance. An additional fee of $5 may be drawn by the lender as a verification fee that can also be partly used as a cost defray in case of database inquiry.

Unlike the practices that existed several years ago, at this time and age, payday loans are a safe debt instrument regulated by state legislature. By issuing and implementing a set of rules regulating cash advances, the government protects borrowers from lenders operating in bad faith. Such measures ensure that lenders only implement financial charges to individuals able to repay their debts without compromising their budget. When not regulated, payday loan payoffs and fees my go out of control, since lenders ensure access to electronic accounts of lenders and draw money from them without considering how well amortized they are.

Online payday loans are regulated by the same laws as those consumers apply for at any approved lender’s office. Basically, the entire procedure one had to undergo in person when applying for a loan has now been moved online, making the things much simpler for consumers. Visiting the company’s office has been taken out of the equation, and this is by far the most tedious and time-consuming part of the application, with consecutive waiting for the decision to come. And think that for many applying for a loan in person means leaving their own job during work hours, which is always frowned upon.

The take-home message is this: being safe, reliably and truly irreplaceable financial tools, payday loans gain popularity as an online facility, all thanks to the elevated ease of this application method. The government guarantees consumer protection when applying for cash advance online or offline.